agreed but how do you convince a bureaucracy to encourage the development of an off-the-wall resource group? The concept is mind boggling but very few managers would feel comfortable with a room full of misfits hovering in the background.Obviously, the larger the municipality the broader the services and deeper the pockets. A dedicated set of emergency services departments reflects the greater potential for public danger due to density, industrial base, transportation corridors, etc.

A township of 5000 has fewer resources but a corresponding lower risk level. Lower doesn't mean non-existent. Weather events don't discriminate but the impact and response of having to accommodate 100 people vs 10,000 is different.

Easier to execute if they are a core drawn (borrowed, seconded, etc.) from other parts of the same organization then return to their positions. Dismissing them to the job market means you may not get them back, or at least not when they are needed. I'm not a fan of using consultatnts for this. They have a different motivation than staff personnel, have to learn the organization and issues, and I suspect quality expertise in disaster management is limited and, for that reason, pricy.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trust in our Institutions

- Thread starter FSTO

- Start date

Brad Sallows

Army.ca Legend

- Reaction score

- 9,037

- Points

- 1,040

Off-the-wall types aren't as misfit as you think. Most are just level-headed, and tend to the kind of people who get calmer the more frantic the situation gets.agreed but how do you convince a bureaucracy to encourage the development of an off-the-wall resource group? The concept is mind boggling but very few managers would feel comfortable with a room full of misfits hovering in the background.

That is why they excel at problem solving but in so doing they often are contradicting the normal and that makes people very uneasy. They are often easy to spot, they are the ones in a group discussion who start every third response with "yes but..."Off-the-wall types aren't as misfit as you think. Most are just level-headed, and tend to the kind of people who get calmer the more frantic the situation gets.

OldSolduer

Army.ca Relic

- Reaction score

- 16,656

- Points

- 1,260

They tend to be quite bright - like the Int O that said "don't go to Arnhem". He made people quite uncomfortable.That is why they excel at problem solving but in so doing they often are contradicting the normal and that makes people very uneasy. They are often easy to spot, they are the ones in a group discussion who start every third response with "yes but..."

daftandbarmy

Army.ca Dinosaur

- Reaction score

- 34,731

- Points

- 1,160

They tend to be quite bright - like the Int O that said "don't go to Arnhem". He made people quite uncomfortable.

Brian Urquhart enters the chat

Arnhem’s Other Urquhart

An obscure British officer expressed misgivings about Operation Market-Garden and shared the name of one of the ill-fated venture’s central figures.

- Reaction score

- 7,169

- Points

- 1,140

Int is like Met, ignored until things go wrong... then the it's first thing blamed.They tend to be quite bright - like the Int O that said "don't go to Arnhem". He made people quite uncomfortable.

RangerRay

Army.ca Veteran

- Reaction score

- 4,299

- Points

- 1,260

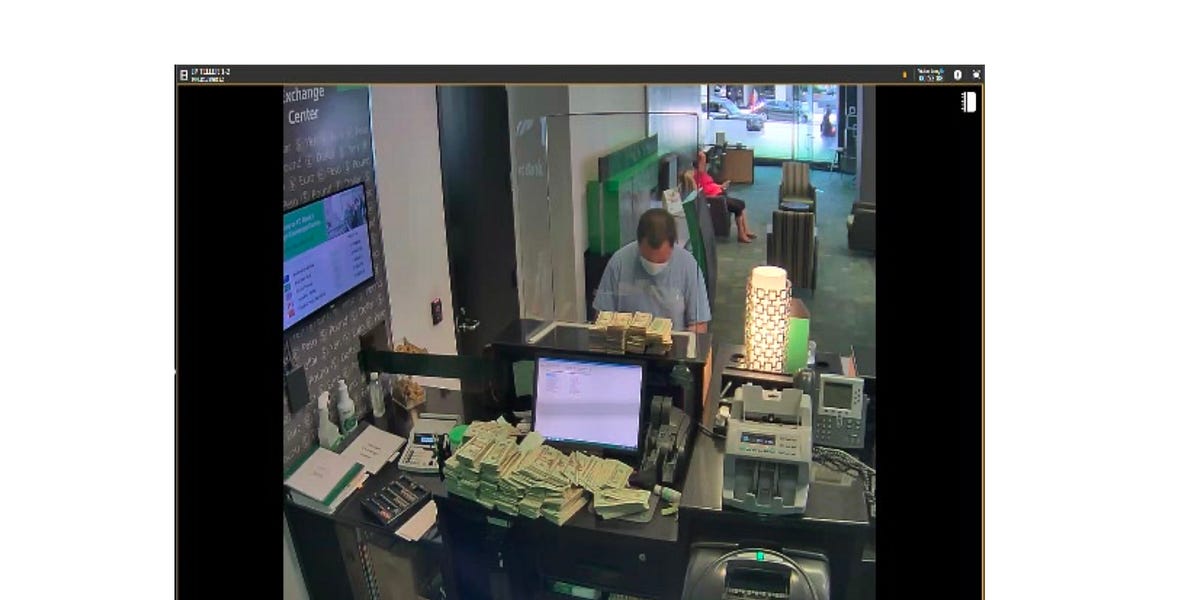

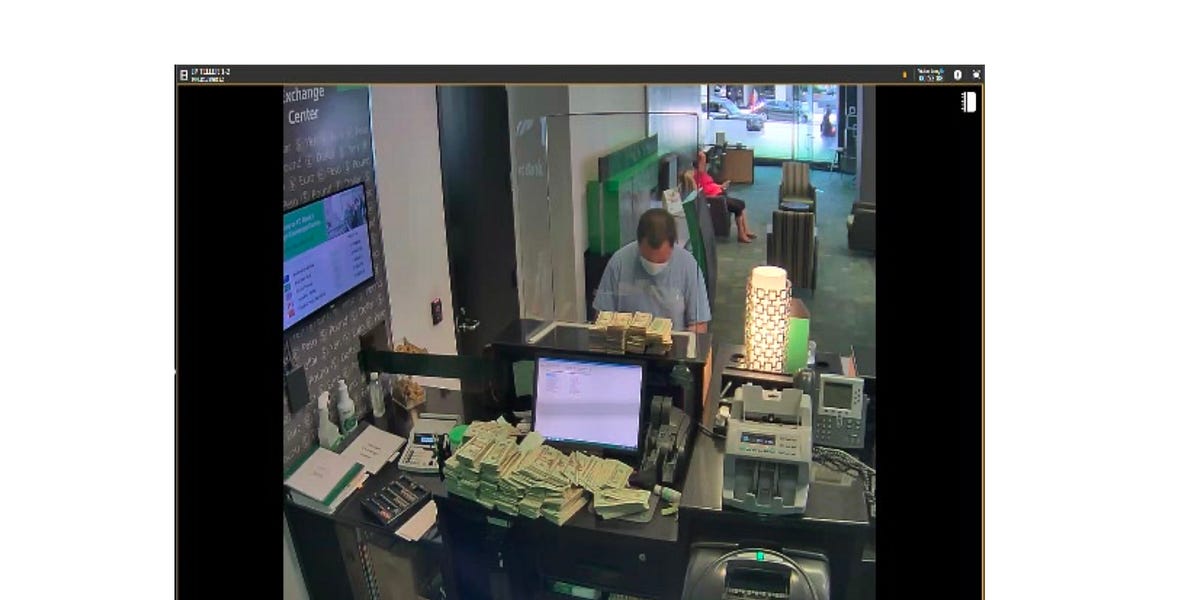

Again, the federal government is falling down at a job, this time regulating the financial sector against money laundering.

www.thebureau.news

www.thebureau.news

U.S. Case Reveals TD Bank's Role in Laundering $670 Million Through $18 Trillion Unmonitored Transactions, Hit with Record $3 Billion Fine

WASHINGTON, United States — In a historic crackdown on criminality that reached into the upper echelons of Canadian banking operations in the United States, the U.S.

“TD Bank created an environment that allowed financial crime to flourish. By making its services convenient for criminals, it became one,” U.S. Attorney-General Merrick Garland said at a news conference in Washington.

Some experts contend that Canada’s regulatory environment has become a haven for international crime.

On Friday, Marc Cohodes, a U.S. investor known for exposing financial misconduct, told The Bureau: "The amount of financial crime going on in Canada right now is far greater than the mind can comprehend. It involves housing, mortgages, and illicit funds flowing in from European, Chinese, and South American networks into Canada's financial systems. The way Canada is welcoming third-world criminals and their funds risks turning it into a third-world enterprise."

Cohodes said he believes Canada’s government has a “dire and urgent need” to address the reputational harm to the nation stemming from the TD case, and other issues, like casino and real estate money laundering in British Columbia, that Cohodes began publicly commenting on in 2015.

TD Bank's guilty plea to conspiring to commit money laundering marks the first time a major U.S. bank has admitted such a charge. As part of the settlement, TD Bank will pay $3 billion in penalties, the largest ever for failing to maintain a compliant anti-money-laundering program. This settlement includes fines directed to the Department of Justice, the Financial Crimes Enforcement Network, and U.S. banking regulators. Additionally, a rare asset cap imposed by the Office of the Comptroller of the Currency restricts TD Bank from expanding in the U.S. without regulatory approval.

Eaglelord17

Army.ca Veteran

- Reaction score

- 2,257

- Points

- 1,040

Nothing new there, we have known for over a decade that we are a money laundering safe haven. Thats what gave our real estate market the initial kick in Vancouver and Toronto. Looks like it’s more than just the housing market that money is being laundered in.

Politicians are afraid to do anything though as that would reduce the funds coming in, thereby helping things stall out.

Politicians are afraid to do anything though as that would reduce the funds coming in, thereby helping things stall out.

RangerRay

Army.ca Veteran

- Reaction score

- 4,299

- Points

- 1,260

How the CSIS warrant story got fleshed out.

www.thebureau.news

www.thebureau.news

Does corruption or incompetence explain why someone sat on a sensitive national security warrant for 54 days? Was it the Minister or CoS who sat on it? Why did the CoS request a briefing on the list of people the warrant subject may be talking to? Did she pass this information on to the PMO?

If this was a cock-up, I figured someone would have offered a mea culpa.

This whole sordid mess is reason enough to topple this government.

How I Developed Sources For The PRC Election Interference Story: Wilful Blindness 3rd Edition Excerpt

Confidential Source 2 informed me of the Michael Chan “Section 21” warrant delays and frustration surrounding the ongoing CSIS investigations that went all the way to Prime Minister Justin Trudeau’s office

Does corruption or incompetence explain why someone sat on a sensitive national security warrant for 54 days? Was it the Minister or CoS who sat on it? Why did the CoS request a briefing on the list of people the warrant subject may be talking to? Did she pass this information on to the PMO?

If this was a cock-up, I figured someone would have offered a mea culpa.

This whole sordid mess is reason enough to topple this government.

- Reaction score

- 18,188

- Points

- 1,010

The evidence seems to be the COS. Whether it was corruption or incompetence remains to seen. With this government, either is likely.

Jarnhamar

Army.ca Myth

- Reaction score

- 7,850

- Points

- 1,160

Our ministers are experts at playing stupid and ensuring they have no situational awareness about what's going on under their own noses.

Bill Blair tells foreign interference inquiry he didn’t know about delayed CSIS warrant

Joly says she wasn't briefed on foreign interference for over a year

FIRST READING: A cursory history of Trudeau ministers being surprised at things they've done

Opposition MPs alleged this is a pattern with the Trudeau government: A federal agency screws up or does something controversial, and the minister in charge declares that they’re as shocked as everyone else. In the words of Conservative foreign affairs critic Melissa Lantsman, “the foreign affairs minister seems very surprised at all the things happening to her.”

- Immigration minister alarmed by his department’s lax student visa policy

- Joly condemns one of her own diplomats partying with Russia

- Public safety minister outraged that his department moved a serial killer to medium security

- Minister unaware his staff were handing out unauthorized travel documents

- PMO invites Nazi to gala, expresses surprise at Nazi invite

- Heritage minister surprised when web giants shut down news like they said they would

Nothing new there.Our ministers are experts at playing stupid and ensuring they have no situational awareness about what's going on under their own noses.

Bill Blair tells foreign interference inquiry he didn’t know about delayed CSIS warrant

Joly says she wasn't briefed on foreign interference for over a year

FIRST READING: A cursory history of Trudeau ministers being surprised at things they've done

On and on our ministers are conveniently clueless.

- Immigration minister alarmed by his department’s lax student visa policy

- Joly condemns one of her own diplomats partying with Russia

- Public safety minister outraged that his department moved a serial killer to medium security

- Minister unaware his staff were handing out unauthorized travel documents

- PMO invites Nazi to gala, expresses surprise at Nazi invite

- Heritage minister surprised when web giants shut down news like they said they would

Ministers would rather not know things than know them.

FSTO

Army.ca Fixture

- Reaction score

- 6,207

- Points

- 1,210

Why does the PMO want to bury a report on our COVID response?

Paul Wells and others have questions.

open.substack.com

open.substack.com

Paul Wells and others have questions.

Walport ahoy!

White smoke over the Health Canada rooftops. But Dr. Naylor has questions.

RangerRay

Army.ca Veteran

- Reaction score

- 4,299

- Points

- 1,260

Yep. I will not be surprised if a Poilievre government will “govern by comms” like the Liberal clown show does now.^^

It’s crap like this that annoys me so much. You commission a report but do SFA to address the issues identified.

I have no faith the next bunch will do any better.

Having said that, the Liberals are in dire need of a long stay in the penalty box. If the Tories refuse to get serious, maybe they finally will? Or maybe with their loosey-goosey leadership rules, Team Hamas will take over?

- Reaction score

- 7,169

- Points

- 1,140

We all know this, but the LPC have taken a tongue-in-cheek joke to the level of policy.Nothing new there.

Ministers would rather not know things than know them.

We have clear exapmles of ministers pretending to not know about core policies/developments in their departments.

That goes well beyond someone spending too much on a Christmas party, or letting a loyal supporter's family through immigration.

RangerRay

Army.ca Veteran

- Reaction score

- 4,299

- Points

- 1,260

Looks like someone involved in Kenny Chiu’s defeat with ties to United Front organizations is running for the BC Conservatives in Burnaby.

bobmackin.substack.com

bobmackin.substack.com

Questions of foreign interference in Burnaby Conservative’s office

Allies of People's Republic of China consulate appear under Michael Wu's red roof

- Reaction score

- 1,648

- Points

- 1,160

54 days is plenty of time to warn everyone that they will be surveilled.

- Reaction score

- 20,504

- Points

- 1,280

Wait - you mean “Lessons Learned” are ignored in places outside the military?!^^

It’s crap like this that annoys me so much. You commission a report but do SFA to address the issues identified.

I have no faith the next bunch will do any better.

FSTO

Army.ca Fixture

- Reaction score

- 6,207

- Points

- 1,210

It’s a Canadian epidemic.Wait - you mean “Lessons Learned” are ignored in places outside the military?!

Similar threads

- Replies

- 3

- Views

- 966

- Replies

- 11

- Views

- 2K

- Replies

- 0

- Views

- 1K