specifically for torontoAnd did this ‘Salary Expert’ website attributes those figures specifically to the CUPE 4400 bargaining unit? Or cite any sources doing so? And did you catch a full cross section of the jobs represented?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Premier Ford To Use "Notwithstanding" Against Education Staff- split fromFreedom Convoy Protests

- Thread starter Bruce Monkhouse

- Start date

And the next move.

toronto.ctvnews.ca

toronto.ctvnews.ca

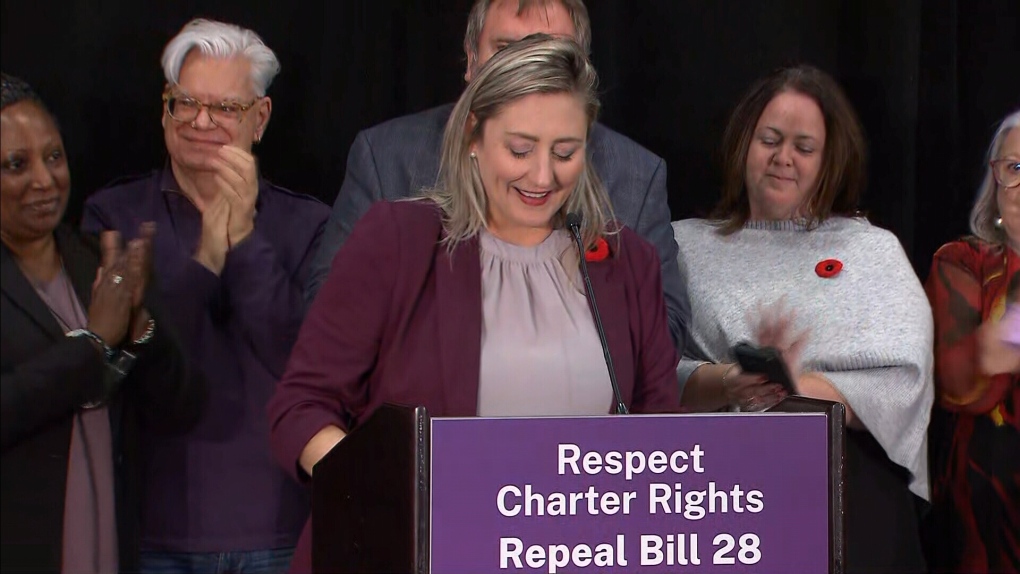

CUPE announces end to strike after Doug Ford offers to rescind education law

The union representing 55,000 education workers across Ontario will end their mass walkout on Tuesday after Premier Doug Ford offered to rescind the legislation that made the strike illegal.

Halifax Tar

Army.ca Fixture

- Reaction score

- 11,161

- Points

- 1,260

And the next move.

CUPE announces end to strike after Doug Ford offers to rescind education law

The union representing 55,000 education workers across Ontario will end their mass walkout on Tuesday after Premier Doug Ford offered to rescind the legislation that made the strike illegal.toronto.ctvnews.ca

Correct me if I'm wrong but don't we have a right to strike in Canada?

This sounds like a panic/scramble move by Ford and his team to me.

lenaitch

Army.ca Veteran

- Reaction score

- 3,654

- Points

- 1,160

That's what invoking the NWC is intended to suspend, primarily 'freedom of association' [2(d)] and 'freedom of peaceful assembly' [2(c)].Correct me if I'm wrong but don't we have a right to strike in Canada?

This sounds like a panic/scramble move by Ford and his team to me.

Halifax Tar

Army.ca Fixture

- Reaction score

- 11,161

- Points

- 1,260

That's what invoking the NWC is intended to suspend, primarily 'freedom of association' [2(d)] and 'freedom of peaceful assembly' [2(c)].

Sounds like unleashing the EA on some noisy truckers to me.

We need better politicians. I know, that's an obvious understatement..

- Reaction score

- 1,488

- Points

- 1,260

We need better politicians. I know, that's an obvious understatement..

They say we get what we deserve. They are our elected officials.

- Reaction score

- 4,175

- Points

- 1,260

Unless I'm misunderstanding you, since funding is, in part, based on enrollment (students in the system, as opposed to students that are supposed to be in the system), that part of the grant would drop if public school enrollment dropped.... No, [the public system] cost and strain don't increase because [its] starting position is that [it has] the cost and difficulties of all students ...

How much the other bit of grant based on "location, student and school needs, and a board’s demographic profile" would make up for that difference, I don't know.

More on how funding is done in Ontario from the Ministry info-machine here.

I know that I direct my portion of taxes to the French Catholic School board. My wife sends hers to the English Catholic board. Neither of us have children in those systems.Unless I'm misunderstanding you, since funding is, in part, based on enrollment (students in the system, as opposed to students that are supposed to be in the system), that part of the grant would drop if public school enrollment dropped.

How much the other bit of grant based on "location, student and school needs, and a board’s demographic profile" would make up for that difference, I don't know.

More on how funding is done in Ontario from the Ministry info-machine here.

- Reaction score

- 27,197

- Points

- 1,090

School taxes (in Ontario at least) are tied to property taxes - do you & your spouse have different residences?

Eaglelord17

Army.ca Veteran

- Reaction score

- 2,041

- Points

- 1,040

Strike is ending tomorrow and the government is repealing Bill 28. Good job Ford et all, way to try to use a sludge hammer on a finishing nail and end up putting a hole in the wall instead.

Nope. But on our voter roll we have different boards.School taxes (in Ontario at least) are tied to property taxes - do you & your spouse have different residences?

We did have two properties until recently. Maybe that’s why I am thinking that.

I’ll have to check our current assessment…

That was a hell of a lineup of senior union figures at the CUPE press conference this morning. I suspect there was a lot of behind the scenes communication between unions and government. Ford was cruising for a potential general strike, and he knew it. I’m curious to see how fast they legislate to rescind Bill 28.

Strike is ending tomorrow and the government is repealing Bill 28. Good job Ford et all, way to try to use a sludge hammer on a finishing nail and end up putting a hole in the wall instead.

This will still leave CUPE negotiating with the possibility of a legal strike should it become necessary. Noticeably, the OLRB stil has not released a decision. That may get set aside as moot. I suspect holding that decision was part of whatever happened between all the parties last night. It gave everyone wiggle room and more ability to save face.

- Reaction score

- 1,488

- Points

- 1,260

Ford was cruising for a potential general strike, and he knew it.

Someone may have explained to him last time Local 416 went on strike.

- Reaction score

- 5,994

- Points

- 1,160

Yet if my grandson goes to a private school, the parents still pay for the public system and his tuition. That becomes a net gain to the public system. Where are they putting that tax money? I am still being taxed for it also. And I have no child in the game. People 70 and over should be exempt.Unless I'm misunderstanding you, since funding is, in part, based on enrollment (students in the system, as opposed to students that are supposed to be in the system), that part of the grant would drop if public school enrollment dropped.

How much the other bit of grant based on "location, student and school needs, and a board’s demographic profile" would make up for that difference, I don't know.

More on how funding is done in Ontario from the Ministry info-machine here.

- Reaction score

- 4,175

- Points

- 1,260

Dividing it up according to enrollment & other factors - good point.Yet if my grandson goes to a private school, the parents still pay for the public system and his tuition. That becomes a net gain to the public system. Where are they putting that tax money?

The other side of that coin is that all Ontarians benefit from well-educated kids. How "well educated" are kids coming out of the current system all you want (what's cursive mean?)? Good question, but by your reasoning, people who don't own cars shouldn't have to pay that bit of tax that doesn't come from gasoline sales that goes into roads, or people who don't take the bus shouldn't pay that bit of taxes.I am still being taxed for it also. And I have no child in the game. People 70 and over should be exempt.

Flip side to that, older residents consume disproportionately higher healthcare resources, while likely contributing less tax to the system than when they were younger and working. Meanwhile, those of us younger and in the workforce are paying for a system many of us barely use.I am still being taxed for it also. And I have no child in the game. People 70 and over should be exempt.

Trying to tailor taxation to match programs and services an individual taxpayer personally uses isn’t a particularly effective system. Many things are best paid for out of consolidated revenue funds rather than on a ‘user fee’ basis.

I don’t think that a users tax for education is a good idea. Public education is a feature of modern society and we all benefit. I’d prefer a tax credit or rebate for taking my child’s education in hand. Be it private school or homeschooling.

- Reaction score

- 5,994

- Points

- 1,160

The strike is done. Kids can back to learning properly, in class. That's been his plan. He cares for the kids first. If he needed a sledge hammer to to force the union into compliance, to provide a proper education, he picked the right tool. I'm happy for the children. I could care less about the union.

I’m also glad that kids are in class. And was on the government’s side of things until they went nuclear.The strike is done. Kids can back to learning properly, in class. That's been his plan. He cares for the kids first. If he needed a sledge hammer to to force the union into compliance, to provide a proper education, he picked the right tool. I'm happy for the children. I could care less about the union.

I’m not sure this was his plan though. I think he miscalculated the reaction and blinked. The union is likely going to be in a better position and you can bet other unions smell blood in the water.

Overall mishandled in my opinion.

Last edited:

- Reaction score

- 5,994

- Points

- 1,160

Myself only. However, I know of many others also. I just used the health system for the first time in two years. I had a normal blood screen and pissed in a cup. The time before that, it was the vaccinations(2) at the very beginning. Which I took to soothe my wife's anxiety in her being ordered to take or lose her job. Otherwise that instance wouldn't be there. Prior to that was blood work again. Without the jabs, it would be three blood tests in 5 years. Lots of us seniors don't use it much more than that. There tons of young people, with covid, that have used the system more than I have in the last 4 years. Not an argument, just an observation.Flip side to that, older residents consume disproportionately higher healthcare resources, while likely contributing less tax to the system than when they were younger and working. Meanwhile, those of us younger and in the workforce are paying for a system many of us barely use.

Trying to tailor taxation to match programs and services an individual taxpayer personally uses isn’t a particularly effective system. Many things are best paid for out of consolidated revenue funds rather than on a ‘user fee’ basis.

Similar threads

- Replies

- 2

- Views

- 12K

- Replies

- 0

- Views

- 6K

- Replies

- 22

- Views

- 31K