Halifax Tar

Army.ca Fixture

- Reaction score

- 13,418

- Points

- 1,260

I wasn't sure where to put this...

www.theglobeandmail.com

www.theglobeandmail.com

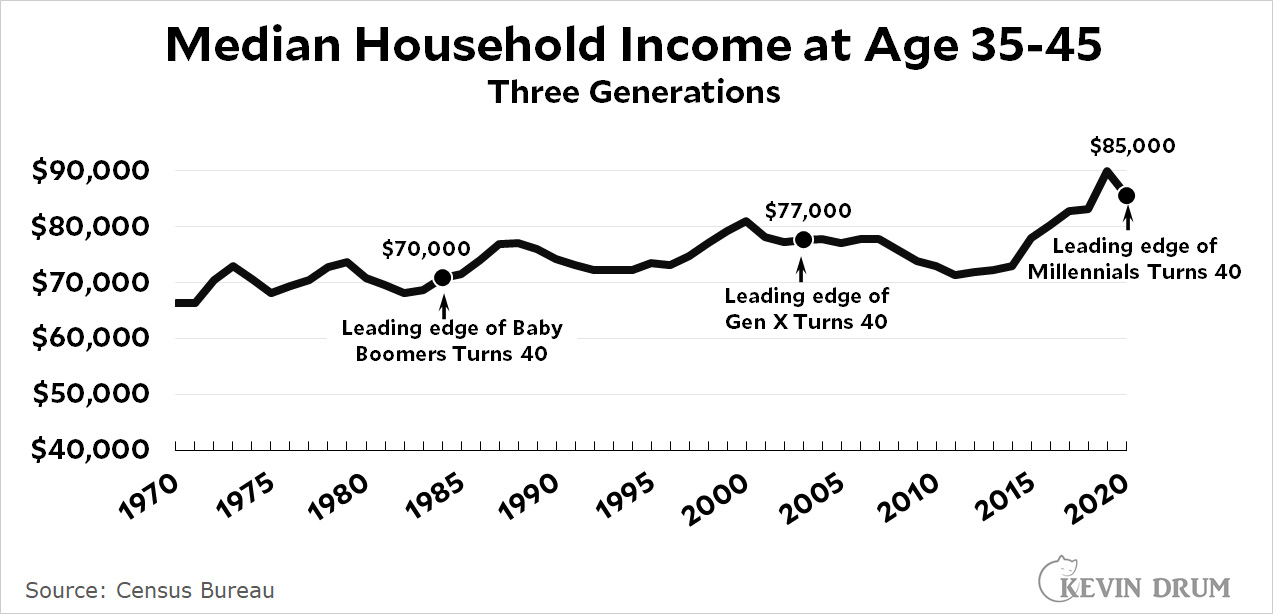

Millennials pay higher taxes for boomers’ retirement - and the burden is only going to increase

Canada’s plans for population aging run afoul of the ‘intergenerational golden rule’ and needs to be remedied